Tax assistance program offers free tax preparation to university students and community

February 24, 2018

The Volunteer Income Tax Assistance program is offering free tax preparation help to all students and community members with annual incomes of under $54,000.

The program is sponsored by Beta Alpha Psi, a College of Business Honors accounting organization.

The VITA program has volunteers that do free tax preparation help from 8 a.m. to 12 p.m. every Saturday, in Rehn 17, the computer lab in the basement of Rehn Hall.

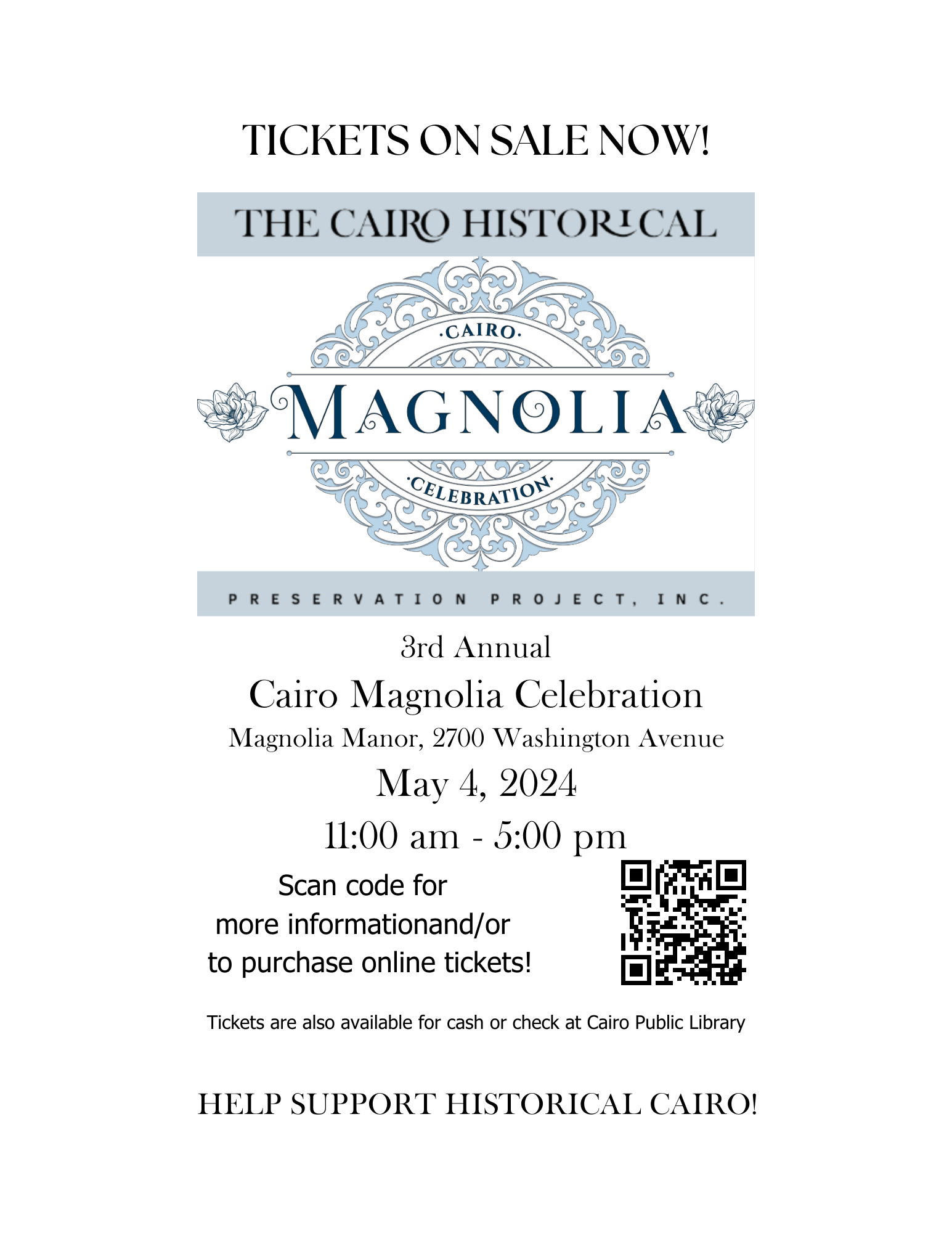

Advertisement

Jared Nicholas, one of the coordinators of the VITA program said they have over 40 volunteers this year. The Internal Revenue Service sends the coordinators the training materials, then the coordinators train the volunteers.

“We, the coordinators, train the students,” Nicholas said. “We usually need about 20 [volunteers] each week, because that’s how many computers we have.”

Anna Li, a coordinator on the VITA program said the program is great for volunteers’ resumes.

“It’s [good] because it’s the experience of actually doing the tax returns,” Li said. “Seeing the work that they’re going to be doing, and then getting to interact with their clients.”

Nicholas said while most of the volunteers are accounting students, not all of them have taken the introductory tax class.

“[In the VITA program,] you run through, you get certified, with different degrees to do tax returns,” Nicholas said. “But the software we use is fairly simplified. So they’re not doing the calculations themselves, they take certification tests to make sure they understand the concept.”

Benna Williams a faculty advisor for the VITA program said even if some volunteers are inexperienced, there’s a lot of resources to make sure their questions are answered.

Advertisement*

“Someone always reviews the returns,” Williams said. “So even if someone may not have very much experience preparing the returns, somebody much more experienced [will] actually reviews the returns for accuracy.”

This tax season is the second time that the VITA program is doing international tax returns.

Li said that as more and more international students come to the university, more of them need help with their tax returns.

“They need to do their tax returns,” Li said. “They need to pay and they’re not familiar with it. So the best way for them to do it is to do the tax returns here.”

Nicholas said that about one-fourth of the clients they have are international students, but the majority of their clients are community members.

“I’d say it’s more community members than students,” Nicholas said. “Because most [US students,] they’re here. Their parents are here, and they can ask them for that kind of stuff. Their parents usually claim them anyway, and they’ll do it all together.”

Williams said that it’s a great opportunity for the volunteer students that are going into accounting, as well as a great opportunity for the coordinators because it’s such a large program.

“It’s [also] great that it helps the community,” Williams said. “Because there’s a lot of times, you see people getting their taxes done at more expensive places, and you say ‘Hey, you could come to VITA and we could do that for free for you.’”

Nicholas said that to get your tax returns done through VITA, you will need valid ID and your social security card. If you are an international client, you will need your passport as well.

“We ask that people bring they have a W2, or 1099, SSA-1099, 1099R, [if applicable,]” Nicholas said. “For students, they might have a 1098-T which is available on Salukinet, that’ll show their school expenses as well as any scholarships that they got.”

The last day of the VITA program is Apr. 14th. There are no sessions on Mar. 10th and 17th because of the university’s spring break.

Staff writer Jeremy Brown can be reached at [email protected] or on Twitter @JeremyBrown_DE.

To stay up to date with all your southern Illinois news, follow the Daily Egyptian on Facebook and Twitter.

Advertisement

Garrett • Feb 26, 2018 at 9:59 am

Wow. What a great-sounding program, and it seems like something you should be able to expand. More experienced accounting students might take on slightly more complicated household situations with larger incomes. And maybe have this part of the program be discounted, but not volunteer, or even set it up as a practicuum for juniors and seniors. Or even small businesses with w-2 and 1099 filing needs. Also curious about the software you use. I’m a small business accountant who uses 1099-etc. https://www.1099-etc.com/