Tuition increases may affect enrollment decline

June 18, 2013

Over the last five years, the university has seen a rise in tuition costs and a downturn in its student enrollment.

MSNBC reported June 10th on the rising cost of tuition in America, which showed a correlation between college tuition and enrollment. The report showed as cost of tuition has increased the last few years, college enrollment has plummeted. Although other factors affect tuition such as living costs and student aid, the report said tuition has seen a large bump overall in the last five years.

Advertisement

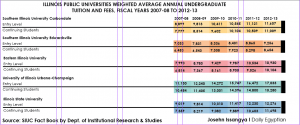

According to the university 2013-2013 Fact Book, tuition for entry level students has increased $2,708 from $8,899 in 2008 to $11,607 in 2012, a 30.4 percent increase. Continuing student tuition has also increased $3,232 from $7,777 in 2008 to $11,009 in 2012, a 41.6 percent increase.

The Fact Book also states that enrollment dropped to 18,667 down from 20,673 five years ago, about a 2,000-student decline.

University spokesman Rod Sievers said it is no secret the university has experienced a decrease in enrollment over the past five years, but it would not be fair to attribute the decrease only to tuition costs.

“Every university has had to increase their cost for tuition as the years have gone on,” he said. “Some universities, like SIUC, are struggling with enrollment, while others are doing well.”

Sievers said the university is funded by two main sources; tuition gathered from enrolled students and money from the state. He said because of Illinois’ economic issues, the state has been reducing the amount of money it provides to higher education institutions for the past several years.

“As state dollars have dwindled, and this applies to all universities in the state, tuition has increased across all colleges to try and offset the loss of state revenue,” he said.

Sievers said if students are struggling to pay for college, they have several options to find additional money, such as financial aid.

Advertisement*

The university Fact Book states since the 2007-2008 school year, college loan funding has increased by $31,151,427 while student work funding has decreased.

The total money students received for work in 2008 was $36,366,820 compared to $34,951,778 in 2013, a total decrease of $1,415,042 over five years.

However, gift aid from the university, such as scholarships, gifts and waivers, has increased by $25,580,619 in the last five years.

“Although the university is increasing tuition, students do understand the importance of a college education. That is why they are paying for it,” Sievers said. “The university understands this and we are working with students to find new ways to pay for rising tuition.”

While some students said they feel differently about the costs, some said they think several of the school’s amenities are worth the money.

Rico Santos, a senior from Dietrich studying information technology, said the tuition at the university is much more than what he paid at Lakeland Community College in Mattoon, but it is worth the cost.

“It is a four-year university, so I do expect to pay more than I did for community college,” he said. “At Lakeland, we did not have a Student Center, Recreation Center, Writing Center or a larger library, so it is nice to have those options even if it does cost more.”

Charlie Katt, a senior from Effingham studying criminal justice, said when on-campus housing, costs for books and meal plans are added to student tuition, the cost nearly doubles for basic amenities easily found outside of campus.

“I think the programs are great, I do think the advisors are really helpful,” he said. “The people that I talk to know what they’re talking about and what they are doing, but I could see how people are wary about coming to college when adding all the expenses together.”

Advertisement