Editorial: How Illinois politicians consciously created these debt and pension crises

August 27, 2016

“Over the years, lawmakers used a variety of techniques to put off paying the bills. … Such techniques can work for only so long, and Illinois is now coming to terms with over 20 years of poor fiscal performance.”

— Business economist Thomas Walstrum, Federal Reserve Bank of Chicago

Some scandal sagas unfold in litanies of detail. Factual dots of who, what, when and where create a linear narrative. Other times we have to absorb decades of dereliction to understand a debacle — such as how this state’s political class devastated Illinois’ public finances. The enormous debt and pension crises now menacing taxpayers didn’t erupt spontaneously, like unexpected tornadoes roaring out of blue sky. Instead:

Advertisement

Illinois politicians consciously invited these crises. Examine the latest evidence of how the perps set up Illinois to fail:

August means dial-out time for vacationers and back-to-school chaos for families. But while many Illinoisans were occupied elsewhere, this August has revealed two insights that the pols -— especially incumbents nervous about re-election — don’t want to see conjoined.

The first revelation explains, in a way we’ve not seen before, how methodically Illinois officials dumped so much debt and unfunded pension obligation on taxpayers. Business economist Thomas Walstrum at the Federal Reserve Bank of Chicago examined a quarter-century’s combined overspending by Illinois state and local governments, the big ones in and around Chicago included.

Each of those governments wants taxpayers to think of its rising debt in unthreatening isolation; Walstrum’s method instead frames all this overspending as one combined wallop with long-term consequences for Illinois taxpayers.

More: Illinois governor loses $400 million vote on teacher pension fund issue

Walstrum reports that while the typical U.S. state was spending an average of 5.7 percent more, year after year, than it had in revenue — a foolish habit, we think — Illinois governments together were spending 15.9 percent more than they had available.

Imagine the compounded effect of overspending your income by 15.9 percent, year after year. Three-fourths of that overspending went to, yes, fat pension promises and other retirement costs. Another big expense: rising interest payments on all this rising debt.

Advertisement*

Walstrum doesn’t go here, but in countless cases that lavish spending, especially in sweetheart pension deals for public employees’ unions, bought incumbents the votes, campaign contributions and Election Day muscle that got them re-elected time and again.

Not only did the public officials spend other people’s money, they spent money that didn’t exist. To cover their tracks, they borrowed vast sums and knowingly underfunded the very pensions they had sweetened.

That sleight of hand wasn’t so visible when plush investment returns propped up Illinois’ public pension funds. The funds were earning annual averages of 8 percent, give or take. So the funds baked those returns into their future projections: As long as returns were 8 percent or so, the funds could stay solvent.

Legislative leaders and governors loved rosy projections; they could repeatedly underfund the pensions. $o they had more $$ to $pend on $exier $tuff!

Which foreshadowed this August’s second revelation: Softer stock market returns and the Federal Reserve’s long clampdown on interest rates are pushing U.S. public pension fund returns to their lowest levels ever. Lousy returns deprive fund managers of money to reinvest and pressure them to lower their too-optimistic forecasts.

Pols and union officials hate that; it frightens retirees and makes taxpayers pay even more into the funds.

This conflict was on display Friday as the Teachers Retirement System, Illinois’ biggest fund, cut its expected annual returns for the third time in four years, from 7.5 to 7 percent. And TRS’ return for the fiscal year just ended? Not quite 1 percent. Ouch. Gov. Bruce Rauner and some legislators are fuming about the extra $400 million or more that taxpayers must pay into TRS to offset weakening returns.

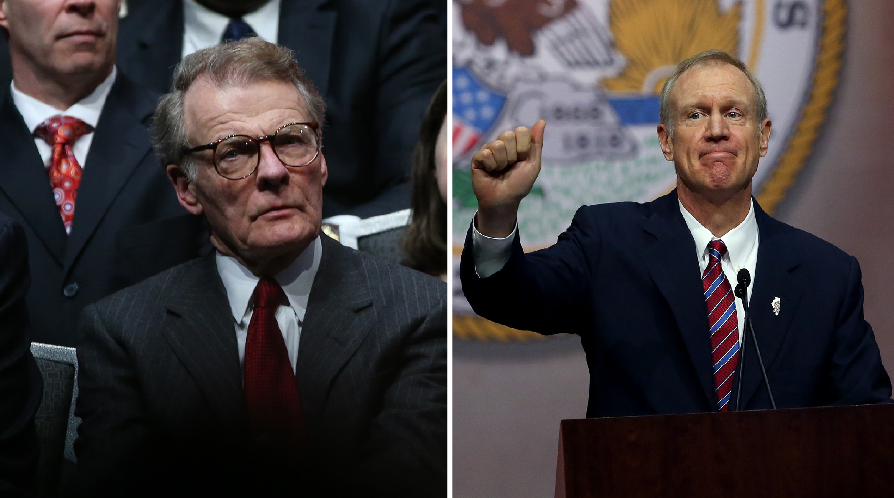

But the blame doesn’t belong with TRS. It belongs with every Illinois politician, House Speaker Michael Madigan and Senate President John Cullerton included, who for many years promised but then didn’t properly fund these pension plans — plans that would be affordable to taxpayers only when times were good.

Imagine the agony when Chicago taxpayers realize that all the higher taxes they have to pay probably won’t fix the city’s pension funds: When those funds, too, face reality and lower their expected returns, Mayor Rahm Emanuel and his successors will explain that the pension system needs, um, many more millions.

All of us can mull what the consequences should be for Illinois officials who (1) year after year spent $1.15 for every dollar they had, (2) didn’t pay their pension and other expenses, and (3) now see higher taxes as their solution.

They knew they were risking the future of Illinois. Yet they kept inflating dangers. Smarter public officials would shift new hires into 401(k)-style plans. Instead, many incumbents see today’s reckonings with debt and pensions not as crises they created, but as crises that simply happened.

Why change how Illinois does business? If only the pols who designed Illinois’ downfall would say, Our fault. We knew better. We’ll resign in disgrace. Say, do you plan to vote Nov. 8?

___

(c)2016 the Chicago Tribune

Visit the Chicago Tribune at www.chicagotribune.com

Distributed by Tribune Content Agency, LLC.

Advertisement