Graduated income tax projected to fail

November 9, 2020

Illinois rejected the graduated income tax amendment by a significant margin.

With all 56 precincts currently reporting in Jackson County, the ‘No’ vote on the amendment leads by 11%, with 12,060 votes to 9,510 votes for ‘Yes.’

Statewide, the ‘No’ vote leads 54.5% to the ‘Yes’ vote that currently holds 45.5%, according to the Associated Press as of 4:48 p.m. on Nov. 8, with 99% of precincts reporting and over five million votes in.

Advertisement

Gov. Pritzker reacted to the results on Nov.4 and said “deep and painful cuts are coming.”

The state has until Dec. 4 to certify election results.

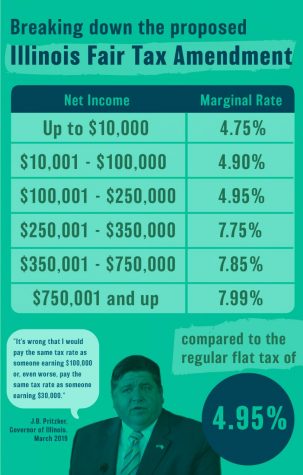

The graduated income tax amendment, if it had passed, would have allowed the state legislature to raise taxes on higher income individuals more than lower income individuals. The state currently has a flat tax rate.

The amendment was passed through both chambers down straight party lines. The bill passed the house on May 30 and the senate on May 31. Sixty percent of the vote was required in both houses to get the amendment on the ballot.

The amendment needed 50% plus one of all the voters in the election or 60% of voters on the amendment itself to pass.

Sports reporter Ryan Scott can be reached at [email protected] or on twitter @RyanscottDE.

To stay up to date with all your southern Illinois news, follow the Daily Egyptian on Facebook and Twitter.

Advertisement*

Advertisement