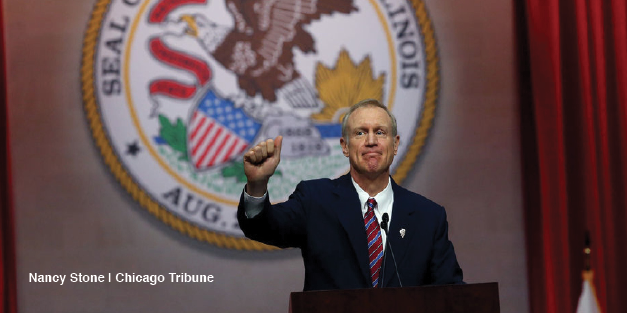

Rauner open to income tax hike, rejects tax on food, medicine

February 15, 2017

Gov. Bruce Rauner is open to raising income taxes and expanding the sales tax to strike an elusive deal on a state budget, but he won’t sign off on proposals that would put new levies on food, medicine and retirement income.

Those are among the guidelines Rauner plans to offer during his third budget address at noon Wednesday, a speech in which he’s expected to put a focus on the sweeping budget blueprint being worked on in the Senate as a path toward ending the historic gridlock that’s left Illinois without a full spending plan since July 2015.

Even before Rauner arrived to deliver his speech, some House Democrats put up signs at their desks reading “Rauner budget = Fake news” and “Rauner budget = alternative facts,” reflecting the current catchphrases in the nation’s capital.

Advertisement

House Republicans asked Democratic Speaker Michael Madigan to force members to take down the signs, but Madigan said the members are “within their rights.”

While Rauner largely has been cut out of Senate negotiations, his decision to wade into the fray now underscores the likelihood that his own budget proposal is unlikely to offer much in the way of new ideas. He has already said his proposal will mirror the format that lawmakers shot down last year. Back then, he presented a plan that was at least $3.5 billion in the red and asked the Democrat-controlled General Assembly to work with him toward an agreement or to give him the power to make massive cuts on his own.

Now Rauner, who is seeking re-election next year amid the record stalemate, is attempting to walk a fine line between trying to offer suggestions for change without being viewed as seeking to derail sensitive talks where special interests on both the left and the right are mustering opposition.

“While the Senate package is still evolving, it wouldn’t be that hard to reach a good deal for taxpayers,” Rauner will tell lawmakers, according to an advance copy of a portion of his speech the administration distributed. “I firmly believe that we can come to agreement on these issues. … This is now a question of political will. I know I’m willing. I hope you are, too.”

While the governor does not plan to propose a specific income tax rate, the measure up for debate in the Senate would raise the personal rate to 4.99 percent from 3.75 percent, just under the 5 percent that was in place under his Democratic predecessor, according to the speech he plans to give.

But Rauner also is expected to say he cannot back a permanent income tax hike unless the Senate plan also comes with a permanent freeze on local property taxes. As it stands, the Senate version calls for a two-year moratorium on property tax hikes in an effort to limit the strain on towns, counties and school districts that heavily rely on such revenue to pay police, firefighters and teachers.

Meanwhile, the governor plans to draw a line when it comes to increasing the state’s sales tax. While Rauner has long been supportive of expanding the tax to various services, he is against a Senate provision that would raise the sales tax on food and medicine.

Advertisement*

The Senate plan would see the state sales tax rate drop to 5.75 percent from 6.25 percent. But the tax on groceries and medicines would increase to 5.75 percent from 1 percent (it’s higher in some places, including Cook County). Critics say raising taxes on food and drugs is regressive because it hits hardest those least able to afford the increase. It’s also unlikely to prove popular with voters.

The governor also is opposed to taxing retirement income, an idea that has been suggested by some government watchdog groups but is not currently included in the ever-changing Senate package. Such a tax would hit older folks who historically are more likely to vote.

“We can find a way to balance the budget without hurting lower-income families and fixed-income seniors,” Rauner plans to say.

The governor also wants the ability for leaders to re-examine income tax rates in the future, saying they could be reduced in the future or surpluses could be given back to taxpayers instead of used to increase government spending. To that end, Rauner also plans to call for a “hard cap” on spending along with unspecified cuts to force “government to live within its means.”

Before he’ll sign off on the additional taxes, the governor said lawmakers must pass “economic and regulatory changes that are significant enough to job creators to get excited about the future of Illinois.” That includes term limits on lawmakers and an overhaul of the workers’ compensation system for employees hurt on the job.

Rauner did not lay out what specific workers’ comp changes he would like, but numerous business groups have said the Senate proposal doesn’t go far enough.

“We are at a crossroads. If we work together and make the right decisions now, the potential of our state is unlimited,” Rauner will say. “Let’s put Illinois back on the road to prosperity. Let’s do what we were sent here to do.”

On education, Rauner is calling for more funding — a total of $7.686 billion in state spending on K-12 schools, which is a $213 million increase over what is being spent in the current year. Of that extra spending, $50 million would go to early childhood education and $30 million would go to general state aid. The extra money would also allow the state to fully fund two categories of spending that have been shorted over the years — transportation, which would receive an additional $107 million compared to last year, and a program for English language learners, which would get $38 million more.

Boosting education funding is one of the few accomplishments Rauner can point to over his two-year tenure at the Statehouse.

In his first budget speech, Rauner called for more spending on K-12 education, and a bill granting that money was one of just two spending bills that the governor didn’t veto in the spring of 2015 when Democrats sent him a budget without enough money to pay for the spending it contained.

The following year, Rauner used his budget speech to call on Democrats to send him a stand-alone education spending bill that would provide another funding boost to K-12 schools. That legislation was ultimately included in a six-month stopgap spending plan. It provided a full year’s worth of education funding, including a boost of $80 million in spending on early childhood education and $250 million in special grants, the majority of which went to Chicago Public Schools.

Last year, Rauner commissioned a task force to examine the way state dollars are doled out to schools, and that panel recently issued a report that recommended the state find a new way to distribute the money so that poorer school districts can receive more funding. The commission recommended increasing spending on schools by at least $3.5 billion over 10 years.

Education Secretary Beth Purvis said the requests in Rauner’s budget don’t envision a change in the formula that determines how dollars are doled out.

“Given the fact that we did not have a new formula passed yet, the governor wanted to make sure that he is investing in the places that, again, through the commission and others that we’ve heard, are very important for districts,” Purvis said.

“Especially that transportation number, we’ve had a number of districts saying that that is an incredibly important piece, to make sure that we are funding that transportation,” Purvis added.

___

(c) 2017 the Chicago Tribune

Visit the Chicago Tribune at www.chicagotribune.com

Distributed by Tribune Content Agency, LLC.

Advertisement