North Korea, trade, business deals: High Asia stakes for Trump

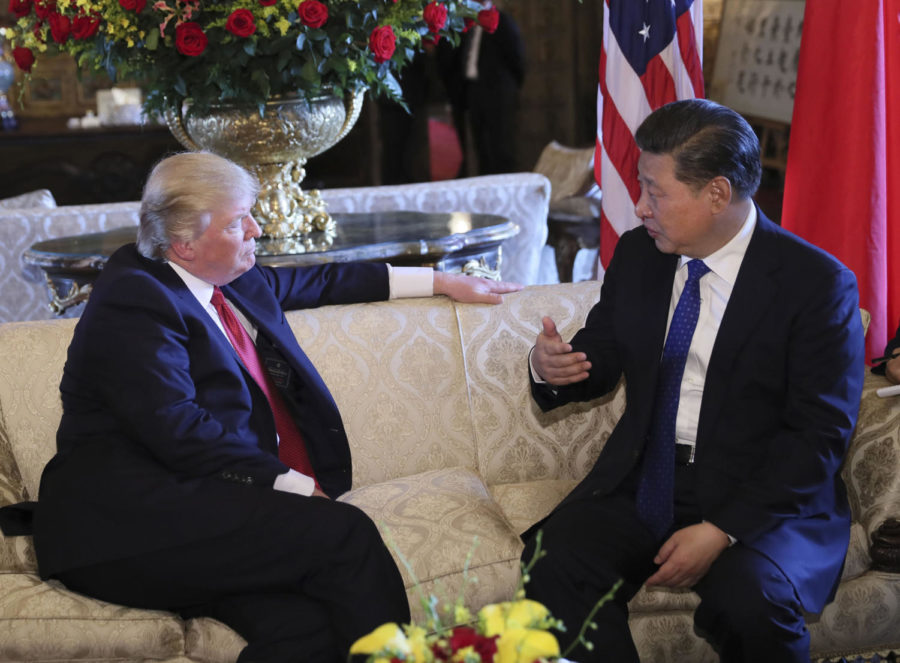

Chinese President Xi Jinping, right, meets with his U.S. counterpart, Donald Trump, in the latter’s Florida resort of Mar-a-Lago on April 6, 2017. (Lan Hongguang/Xinhua/Sipa USA/TNS)

November 2, 2017

President Donald Trump embarks Friday on a five-nation tour through Asia — his longest foreign trip yet — where he’ll confront some of the most significant tests of his national security and economic agendas.

Trump arrives in Asia amid deepening concerns over North Korea’s nuclear and ballistic missile programs. Key allies in Tokyo and Seoul will be looking for reassurance in the face of dangerous provocations from Kim Jong Un and bellicose statements from the U.S. president himself. Trump hopes to court China into exerting more pressure on Kim’s regime.

The president also needs to deliver wins as he visits some of the world’s biggest economies, having campaigned on his unique ability to craft deals and upend trade practices he argues hurt American workers. Achieving that, however, will be tough. Leaders in the region are still stinging over Trump’s decision to withdraw from the 12-nation Trans-Pacific Partnership trade deal.

Advertisement

Adding to the challenge, Trump arrives in Asia politically hobbled after charges were filed this week against three former campaign officials as part of special counsel Robert Mueller’s investigation into Russian interference in the 2016 election. While Trump grapples with a historically low approval rating, he’ll be negotiating with leaders including Chinese President Xi Jinping and Japanese Prime Minister Shinzo Abe, who have recently solidified their holds on power.

Here is what’s at stake:

Perhaps more than any other world leader, Abe has actively sought to build a close relationship with Trump. The Japanese prime minister has two major goals for this visit: ensuring that the U.S. will defend Japan from Kim’s nuclear threat, and staving off Trump’s attacks on their lopsided trade relationship.

The U.S.’s $69 billion trade deficit last year with Japan was second only behind China, fueled by American imports of cars and electronics. Earlier this year, the two nations created a separate economic dialogue to smooth out differences over currency and trade, particularly agricultural tariffs and American car sales in Japan.

The talks have yielded some success, but the sides remain far apart on other top trade issues. U.S. negotiators are keen to remove a safeguard mechanism on imports that has increased Japanese tariffs to 50 percent from 38.5 percent on U.S. frozen beef, resulting in a 26 percent drop in imports in August compared with the previous year.

In addition to formal talks, Abe is wooing Trump with a trip to the golf course.

In contrast to Trump’s warm relationship with Abe, his dealings with South Korean President Moon Jae-in got off to a rocky start. Moon won an election in May after pledging to seek dialogue with North Korea and review a U.S. missile defense system. Meanwhile, Trump called for a renegotiation of the trade pact between the two nations that he sees as fueling a $28 billion trade deficit.

Advertisement*

On this trip, the leaders are likely to show a united front against Kim, even while underlying tensions remain. South Korea hosts more than 28,000 U.S. troops and relies on the alliance to deter a North Korean attack. Longer term, Moon wants to take the “driver’s seat” when it comes to the Korean Peninsula, including a quicker timetable on the U.S. military transferring operational control to South Korea in wartime.

The Trump administration has criticized South Korean policies limiting auto imports produced under U.S. standards to 25,000 per year. The administration also complained about the South Korean production of tubular goods used for drilling, extraction, and transport of oil and natural gas. The U.S. hiked tariffs on oil tubular goods imported from South Korea earlier this year after a glut led to the idling of several U.S. steel mills.

Trump’s first state visit to China comes right after Xi’s historic consolidation of power at a once-in-five-year party leadership conference. At stake is a range of issues separating the world’s biggest economies, from North Korea’s nuclear threat to trade imbalances to market access.

While Trump repeatedly bashed China on the campaign trail, he’ll be looking for some big deals when he brings a large business delegation to Beijing. He’s received a few concessions already this year: China has promised to buy U.S. rice and liquefied natural gas under long-term contracts for the first time. Reports suggest that it may further open the financial services and electric vehicle sectors.

The U.S. president will also press his Chinese counterpart to take steps toward a more market-oriented economy, remove state subsidies for industries competing with American manufacturers, and offer reciprocal treatment for U.S. companies looking to set up shop in China.

Xi will be looking for Trump to join his signature Belt-and-Road Initiative, a move that would allow Chinese companies to build high-speed rail lines and other infrastructure in America. In return for any economic deals, China will likely press Trump to drop a probe into its alleged theft of intellectual property from U.S. companies, though White House officials say Trump still plans to press the issue.

Analysts caution that many of the deals the leaders plan to unveil would have proceeded without the pomp and circumstance of Trump’s state visit, and that any signals of comity between the two leaders may be short-lived.

Vietnam is looking to re-energize bilateral relations with the U.S. after Trump pulled out of the TPP. The Communist Party leadership wants closer economic ties with the U.S. to boost its export-dependent economy and reduce its reliance on Beijing. China accounted for 21 percent of Vietnam’s total international trade in 2016, almost twice as much as a decade earlier, while the U.S. accounted for about 13 percent, according to International Monetary Fund data.

Vietnam is likely to court Trump by easing investment restrictions and signing large business deals to blunt criticism over a trade surplus with the U.S. that more than doubled in five years. When Prime Minister Nguyen Xuan Phuc visited the White House in June, Vietnam presented a bundle of such commercial deals.

In Manila, Trump will meet a leader who shares his affinity for speaking bluntly. President Rodrigo Duterte, who cursed out former President Barack Obama last year for criticizing his war on drugs, said this week that he and Trump “move our mouths in the same cadence.”

Duterte will be looking for Trump to avoid criticizing his anti-narcotics war while furthering economic and military ties. The U.S. is one of its largest foreign investors and its third-largest trading partner.

While Duterte publicly announced a shift toward China last year, ties with the U.S. have improved recently. U.S. drones, surveillance and intelligence eventually helped Philippine forces clear Marawi City in the nation’s south from Islamic State-linked terrorists.

___

(c)2017 Bloomberg News

Visit Bloomberg News at www.bloomberg.com

Distributed by Tribune Content Agency, LLC.

Advertisement