No freedom for only US defendant linked to Panama Papers

September 8, 2016

WASHINGTON — A federal judge ruled Thursday that the only person in the United States known to be prosecuted in connection with the Panama Papers must remain in jail after more than a year there.

Chetan Kapur, an India-born New York investment manager, has been held since July 2015 on contempt charges for refusing to cooperate with a judge over secret offshore accounts that lawyers say belong to him. Kapur’s offshore activity was revealed in a now-famous breach of internal documents from the Panamanian law firm Mossack Fonseca, also known as the Panama Papers.

During his previous status hearing July 7, U.S. District Judge Paul Engelmayer gave clear orders to Kapur and his attorneys to turn over emails from Google accounts and information on missing cellphones that Kapur used for email.

Advertisement

On Thursday, Engelmayer, who sits on the bench in the Southern District of New York, cited those promises in his determination to keep Kapur behind bars until at least the next hearing on Oct. 28.

Engelmayer also urged Kapur, who entered the courtroom shackled and chained, to find a way to authorize Swiss authorities to free money held in offshore accounts.

The Securities and Exchange Commission had argued in a Wednesday pre-hearing filing for Kapur’s continued detention. The agency said Kapur still had not given a deposition in the case that the judge had ordered in July.

“The keys to the jail cell are — as they have always been — in Kapur’s hands,” SEC Attorney Michael J. Roessner wrote.

Kapur’s contempt jailing involves failing to make restitution to investors in a civil settlement he reached with the SEC in late 2011. Since then, the owner and operator of ThinkStrategy Capital Management has drawn the ire of Engelmayer, who sarcastically said in July: “I’m sorry it’s taken one year for the message apparently to get through” to Kapur.

Kapur maintains he can’t make restitution because he lost money alongside his investors. But he and his brother Kabir appear in the Panama Papers with secret offshore companies in Panama and elsewhere that moved money to and from Swiss bank accounts.

Lawyers for victims and the SEC think the offshore companies helped shield three Swiss bank accounts that collectively contain at least $4.3 million. The accounts are in Bank Vontobel and Bank J. Safra Sarasin.

Leaked documents from Mossack Fonseca show that Kapur transferred ownership of some of the assets in 2012 to his brother after authorities brought criminal charges.

Advertisement*

The SEC argued in its pre-hearing filing that Swiss authorities have frozen the accounts associated with the Kapur brothers and “the funds should be repatriated, and that any distribution of these funds should be directed by this court.”

For that to happen, the SEC needs the judge to have Kapur give consent, then the court will ask the Swiss banks to lift their freeze and deliver the money to U.S. regulators on behalf of Kapur’s investors.

Engelmayer, during the July 7 hearing, swatted away attempts to bring the Panama Papers directly into Kapur’s case, saying that for the moment he was not interested in admitting “internet-based evidence.”

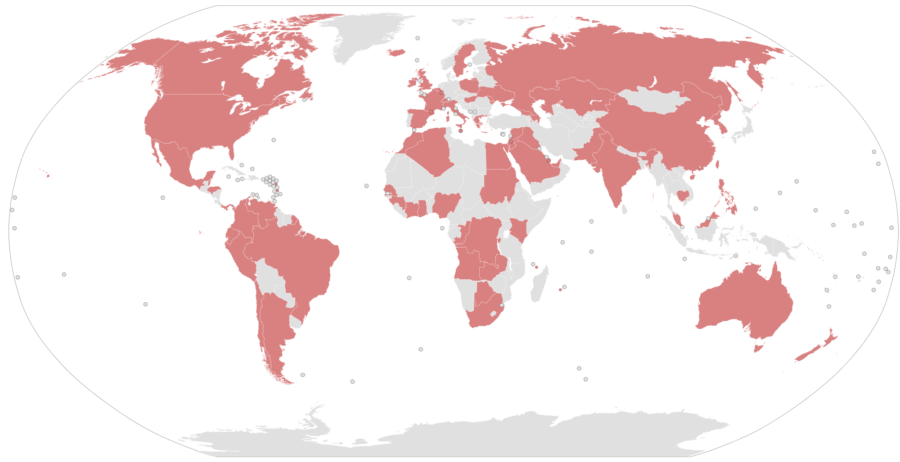

That was a reference to the portions of the Panama Papers leak that are now publicly available on a searchable database. It’s operated by the International Consortium of Investigative Journalists, the Washington-based umbrella group for reporters from McClatchy and other news organizations across the globe that collectively reported on the secret documents earlier this year.

The Panama Papers created great interest in the Kapur case in his native India, where Kabir Kapur reportedly now resides.

In the United States, President Barack Obama put forth some proposals to make it harder to use the United States as an offshore tax haven, though nothing has happened. The Department of Justice and the Internal Revenue Service have both repeatedly declined to comment on possible investigations of people found in the Panama Papers to be using offshore accounts.

Mossack Fonseca has resigned from the business it did in Nevada and Wyoming, two leading states for mostly anonymous incorporation.

Panama promised to fully investigate whether criminals were using the country to hide and launder money, even creating a special committee for that purpose.

But two prominent appointees to that panel resigned last month: Nobel Prize-winning economist Joseph Stiglitz, a Columbia University professor, and Swiss anti-graft expert Mark Pieth, from Basel University. The pair stepped down after they said Panama had declined to make the commission findings public.

In a statement, Panama’s Foreign Ministry lamented their departure and said the report would be made public, citing “internal differences” for the resignations.

___

(c)2016 McClatchy Washington Bureau

Visit the McClatchy Washington Bureau at www.mcclatchydc.com

Distributed by Tribune Content Agency, LLC.

Advertisement