Illinois submits Obamacare insurance premium increases to feds

August 25, 2016

Illinois consumers are one step closer to facing sky-high increases for individual health insurance plans purchased through the Affordable Care Act’s marketplace.

The Illinois Department of Insurance said Wednesday it has submitted rate increases to the federal government that for some types of plans average 43 percent to 55 percent.

The Center for Medicare and Medicaid Services will decide rates. But the numbers released Wednesday confirm the fears of consumers, who’ve already watched a number of insurance companies withdraw from the Obamacare exchange because of financial losses, limiting choices as people prepare to enroll for 2017.

Advertisement

Rates could increase by an average of 44 percent for the lowest-priced bronze plans, 45 percent for the lowest-priced silver plans and 55 percent for the lowest-priced gold plans, according to a preliminary analysis released by the state Wednesday.

Here’s what those percentages mean: A 21-year-old nonsmoker buying the lowest-priced silver plan in Cook County next year could pay a premium of $221.13 a month, up from $152.42 a month this year.

In Lake and McHenry counties, that consumer could pay $268.03 a month for the lowest-priced silver plan there, compared with $212.23 a month this year.

Those numbers, however, don’t include the tax credits that 75 percent of Illinoisans on the exchange now receive to help offset the cost of premiums.

The U.S. Department of Health and Human Services released a report Wednesday showing that even if insurance premiums for individual exchange plans swell by 50 percent next year, two-thirds of Illinois residents who buy insurance through the Obamacare exchange would pay $100 or less for premiums after accounting for premium tax credits.

Still, the double-digit rate increases are sure to spur questions among the 335,243 Illinoisans receiving insurance through the exchange. About 25 percent of exchange customers in Illinois — nearly 84,000 people — didn’t receive tax credits.

Anne Melissa Dowling, acting director of the state’s insurance department, blamed the federal government for the price increases, saying Washington failed to fulfill its financial obligations to insurers under the Affordable Care Act.

Advertisement*

“While these rate approvals result in a very difficult outcome for consumers, they were necessary to ensure that all Illinois consumers actually have an option for coverage when the 2017 Open Enrollment begins on November 1, 2016,” Dowling said in a release. The department did not make her available for an interview.

The state attributed the increases to the absence of certain payments promised by the federal government under the Affordable Care Act and rising medical and pharmaceutical costs, among other things.

The Department of Insurance reviewed the rates but did not have the power to change or reject them. It did, however, as a so-called “file and use state,” have the power to try to negotiate better rates with insurers.

“Just because it’s a file and use state doesn’t mean a state has no ability to push back on rates,” said Sabrina Corlette, a research professor at Georgetown University’s Center on Health Insurance Reforms.

Dana Holmes, a spokeswoman for Blue Cross Blue Shield of Illinois, the most popular insurer on the exchange, said in a statement that the insurer is confident the individual rates it filed are “reasonable” and “actuarially justified.”

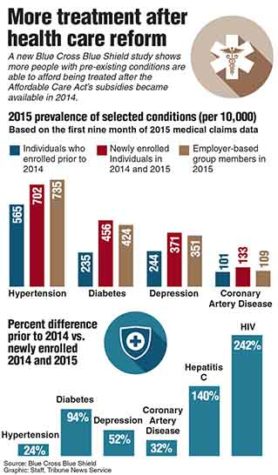

Graphic showing the increase in treatment of people with pre-existing conditions after Obamacare was available.

“In order to continue offering plans in 2017, we must price our products for the anticipated health care needs for the entire market,” Holmes said.

Stephani Becker, a senior policy specialist at the Sargent Shriver National Center on Poverty Law, called the rates “disappointing” but said it’s important to remember that tax credits will limit how much most Illinois consumers on the exchange actually pay. The preliminary analysis also showed dwindling choices for many Illinois residents.

Aetna recently announced that it, along with its brand Coventry, would not offer individual plans on the exchange in Illinois next year. Nor will UnitedHealthcare or Land of Lincoln.

Cigna is new to the individual exchange in Illinois next year. Its HMO plan will be offered in Cook, DuPage, Kane, Kankakee and Will counties, according to the Department of Insurance.

Despite challenges, federal officials said Wednesday during a call with reporters that the Affordable Care Act has led to improvements in health care for many throughout the country.

“I think it’s important to step back and remember what the health insurance market and individual market was like before the Affordable Care Act where folks with pre-existing conditions had no options for” appropriate coverage, said Mandy Cohen, chief operating officer and chief of staff at the Centers for Medicare and Medicaid Services.

___

(c)2016 the Chicago Tribune

Visit the Chicago Tribune at www.chicagotribune.com

Distributed by Tribune Content Agency, LLC.

Advertisement