Illinois higher education funding questions linger despite emergency bailout

April 27, 2016

After the Legislature passed an emergency higher education funding bill Friday, I got an email from a reader asking a question that’s central to the budget crisis and deserves some discussion:

I wonder if you could answer a question re: the state budget. With the stalemate in the legislature holding up funding for many entities such as the community colleges, if this should go on for the whole year will the entities permanently lose the FY2016 dollars, or will there be a retro funding of FY2016 monies in FY2017?

This is the biggest and most important question for Illinois’ nine public universities, all its community colleges and in the neighborhood of 125,000 low-income students who in normal budget years would receive tuition assistance from the state’s Monetary Awards Program grants. The next biggest question is, if any of the missed funding from FY 2016 is made up, how much will it be?

Advertisement

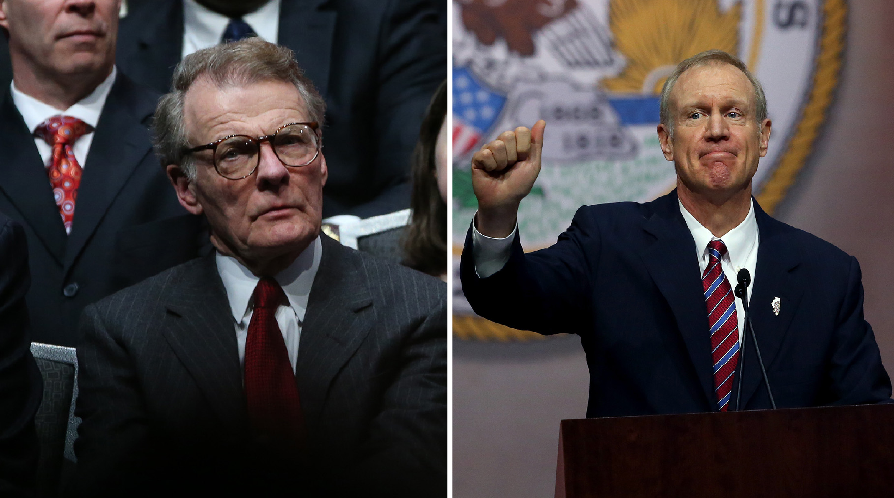

We don’t know the answer to either of those questions because, at this writing, budget negotiations are stalled. But we do know that both the Rauner administration and Democrats in the Legislature have discussed the need for a two-year budget that would backfill FY 2016 spending and create a plan for the budget year that begins July 1. Keep in mind, though, that FY 2016 spending already is in the red (the comptroller’s office lists just shy of $7 billion owed at the moment) and that’s before any money for higher education or social services is budgeted for the year that’s almost over.

All told, the Governor’s Office of Management and Budget estimates uncontrolled spending that’s happening this year will exceed revenue by $4.4 billion.

So any higher education funding for the current year will need to come from new revenue sources, either more tax money or cuts somewhere else. For context, each percentage point in income tax increase brings in an estimated $3.2 billion.

To make a somewhat educated guess as to what’s in store for higher education, it’s important to understand where we’re at today and how far apart Rauner and the Democrats who control the General Assembly were when budget talks broke down last spring.

Had Rauner and the Democrats a year ago met halfway on their respective higher education budgets, funding would have fallen by around 11 percent to $1.74 billion. Rauner’s proposal for next year, in fact, does just that. (Rauner’s 2017 budget summary is on page 63 at this link.)

As for the missing 70 percent from the current year, students and schools have some reason for optimism if the two sides ever get together on a long-term plan. The $600 million approved last week came from unused money in special funds. So “backfilling” to meet a compromise on the two budget proposals from last year means finding roughly $1.15 billion. Rauner has proposed changes to the state’s procurement system that he says can provide $500 million for higher education.

Enact that reform and it’ll take $650 million in new revenue to meet halfway on the two FY 2016 proposals. Then again, there’s a pension reform proposal in play that has the support of both Rauner and Senate President John Cullerton. It’s estimated to save the state $1 billion a year — if it survives an inevitable court challenge, which Cullerton believes it will.

Advertisement*

Reminder: Pensions will make up 21 percent of General Revenue Fund spending this year.

On the tax side, we know that raising income taxes by 1 point brings another $3.2 billion. There’s also a progressive income tax plan out there that backers say will boost state collections by $1.9 billion annually. The Civic Federation, in its “2017 Budget Roadmap” report, estimated that changing the state sales tax to include services would add $469 million in 2017.

You get the picture. Making all these suggestions add up to the $4.4 billion the state needs to break even won’t be easy, but it’s not impossible.

All sides involved in the budget have conceded that we won’t turn Illinois state finances around without a mix of new tax revenue and savings. They’re both there, ready to be discussed.

Here’s hoping those discussions happen soon and that last week’s action to temporarily save a great college system from collapse is indicative of a greater resolve to prevent this ever happening again.

___

(c)2016 Reboot Illinois

Visit Reboot Illinois at www.rebootillinois.com

Distributed by Tribune Content Agency, LLC.

Advertisement