Democrats and Republicans discuss the graduated income tax amendment

October 17, 2020

Next month Illinoisans will have the option to vote on the Graduated Income Tax Amendment.

The amendment, if passed, would repeal the part of the Illinois constitution guaranteeing all residents pay the same state income tax percentage.

This spring the amendment passed both the Illinois House of Representatives and the state Senate, with a 60% vote required in both houses to put the amendment on the ballot.

Advertisement

The bill passed the senate 36-22 on May 1, and the House 67-48 on May 30.

For the amendment to pass in November, it will require 60% support from all the people who vote on the amendment itself, or a simple majority of all Illinois voters in the November election who vote on any part of the ballot.

In the legislature, every Democrat voted in favor of the amendment and every Republican voted against it.

Rep. Darren Bailey, a Republican from the 109th district which includes Edwards, Jasper, Richland, Wabash, Wayne, and White and parts of Effingham and Lawrence county, said Illinois has a spending problem and raising taxes is the wrong way to approach it.

Illinois has had a declining population and Bailey said a tax amendment will continue that decline.

“So we see the proof of high taxation in Illinois,” Bailey said. “Illinois is indeed the highest taxed state in the Union, you know, we have the highest property taxes, of any state in the Union so we know for a fact that people are leaving the state.”

Rep. Patrick Windhorst, a Republican who attended SIU’s School of Law and graduated in 2000, represents the 118th district and voted against the tax amendment. The 118th district includes Alexander, Gallatin, Hamilton, Hardin, Jackson, Johnson, Massac, Pulaski, Pope, Saline, and Union Counties.

Advertisement*

“What I view as the number one problem facing Illinois is our loss of population, particularly in the southern part of the state, and what I see is that additional taxes will lead to more people moving out of the state,” Windhorst said. “What this will do in my opinion, if this scenario were to pass, it will make it easier politically for the General Assembly to raise taxes on certain portions of the population, and that will cause more people to move out.”

Rep. Will Davis, an SIU alumnus in the class of 1989 and Democrat represents the 30th district in Cook County and is also an assistant majority leader in the House of Representatives. Davis voted in favor of the tax amendment.

“This is where we are going to draw the line in terms of our desire to ask that class of individuals to pay a little bit more of their income as it relates to those that make less,” Davis said.

Gov. J.B. Pritzker has supported the income tax amendment vocally and financially.

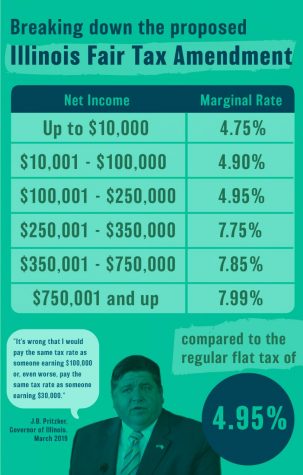

Pritzker has given more than $56 million in support of the amendment for advertisements and has said “it’s wrong that I would pay the same tax rate as someone earning $100,000 or, even worse, pay the same tax rate as someone earning $30,000.”

Bailey said he is skeptical of the tax savings for 97% of Illinois taxpayers.

“We know that the flat tax rate is 4.95%. We’re being told that 97% of Illinoisans are going to get a tax break. Well, some of the math that was performed early on in this has been in 2019,” Bailey said. “Some of the math that was performed on these very same figures is a 4.75% tax rate on the middle class. So, you’re looking at a point to percent of a tax break. And when you look at all the income levels and put them together you’re essentially looking at about $6.73 tax savings [per taxpayer].”

Davis said the tax has some support from those who would have their taxes raised. “There are some very wealthy people in Illinois that appreciate and agree that they should pay a greater portion of their tax than they’re currently paying”

Davis said there currently are no specified plans on where the extra money would go if the amendment passed but he would support education funding.

“We want to get to $3.5 billion more in education funding, this presents an opportunity to do that,” Davis said.

Davis said if more state funding went into schools there would be an opportunity for lower property taxes at the local level.

Bailey and Windhorst both expressed concern over the possibility of the assembly raising taxes on the upper and middle class even more.

“The fear is that that’s where this progressive tax amendment is going to go after. It’s going to go for where the money is at, and that is where the people are at and that’s in the middle class,” Bailey said.

Bailey also said he thinks there could be serious implications for southern Illinois if the amendment passes.

“It is already devastating because it’s going to be a tax for people, job opportunities are limited in our area, people are moving out and you just simply drive, and I’m sure you see this, the help wanted signs everywhere. That’s a sign of a lack of people to fill the needs,” Bailey said

Windhorst expects Democrats to continue to raise taxes for all taxpayers and not just for the top 3%.

“My belief is the General Assembly and the governor will continue to propose additional tax increases, even below $250,000 which I would oppose, of course, but I don’t think there was adequate protections for middle class taxpayers with the constitutional amendment,” Windhorst said.

Davis, however, said the tax rate could already be lifted, but if it were, it would have to be lifted for everybody. He said they’re still working to find what the perfect rate is.

“So that we are maximizing our opportunity but still trying to work within a certain confine of not driving people out of the state,” Davis said.

Sports reporter Ryan Scott can be reached at [email protected] or on twitter @RyanscottDE.

To stay up to date with all your southern Illinois news, follow the Daily Egyptian on Facebook and Twitter.

Advertisement