Illinois treasurer, Hillary Clinton take aim at Wells Fargo over scandal

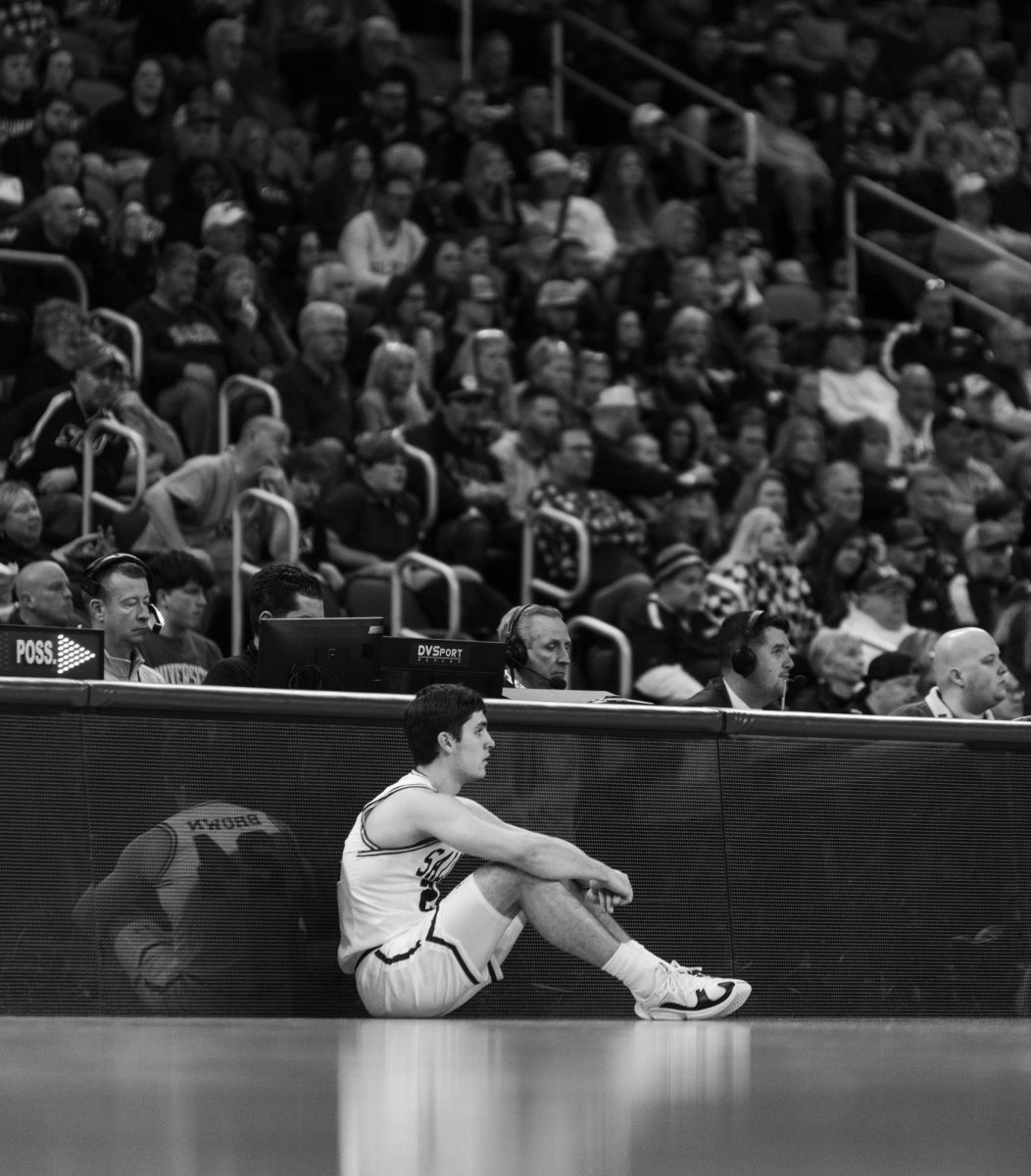

Illinois Treasurer Michael Frerichs. (Michael Tercha/Chicago Tribune/MCT)

October 3, 2016

The fallout over a fake accounts scandal widened Monday for Wells Fargo, with officials in Illinois pulling business from the bank and Democrat Hillary Clinton targeting the company on the presidential campaign trail.

Illinois State Treasurer Michael Frerichs on Monday said he was suspending $30 billion in investment activity with the San Francisco-based bank, while Chicago Treasurer Kurt Summers said he is divesting $25 million invested with Wells. The move follows a similar step by California’s treasurer last week.

In North Carolina, the office of State Treasurer Janet Cowell said it’s monitoring the situation and studying “whether Wells Fargo’s past business practices had any effect on North Carolina government accounts.”

Advertisement

The treasurer’s office has “no plans to take any additional action at this time,” spokesman Brad Young said.

On Sept. 8, Wells agreed to pay $185 million in fines over allegations of “widespread illegal” sales practices that dated to at least 2011. Regulators said bank employees, racing to meet aggressive sales goals, opened two million accounts that may not have been authorized by customers.

The revelations have led to congressional hearings, additional federal investigations and calls for Wells Fargo CEO John Stumpf to resign.

Wells has its biggest employee hub in Charlotte, N.C., with more than 23,000 employees.

Wells spokesman Gabriel Boehmer said the bank has worked with the State of Illinois and the City of Chicago since 1970 in a unit that is separate from the retail bank, where the accounts scandal took place.

“We certainly understand the concerns that have been raised,” Boemer said. “We are very sorry and take full responsibility for the incidents in our retail bank.”

The treasurers’ actions are mostly symbolic. They will cost the bank a few million dollars in fees, according to the Los Angeles Times, which is relatively small for a company that posted a 2015 profit of $22.9 billion.

Advertisement*

Meanwhile, Clinton said she would work to curb the use of arbitration clauses that can make it harder for consumers to sue companies.

Lawmakers have said such clauses at Wells Fargo will make it more difficult for customers to bring claims over unauthorized accounts at the bank.

“We saw one of our country’s biggest banks, Wells Fargo, bully thousands of employees into committing fraud on unsuspecting customers,” the campaign said in a statement, vowing to restrict practices that “businesses like Wells Fargo have used to lock the consumers they’ve harmed out of court.”

Wells Fargo spokesman Mark Folk said the bank is “working to make things right” if any customer has a product or service they don’t want or need. In cases where customers received a product they did not authorize in connection to the bank’s recent settlement, Wells is providing free mediation “through an impartial third party,” he said.

Stumpf on the hot seat

Wells CEO Stumpf has faced searing questioning from Senate and House committees for his oversight of the bank, with some lawmakers calling on him to step down and to face prosecution.

Stumpf has repeatedly said he was “deeply sorry” for the San Francisco-based bank’s conduct, and on Sept. 27 the bank’s board announced he would forfeit all of his outstanding unvested equity awards, worth $41 million, and forgo his salary during a board investigation.

He had given no indication he plans to leave, saying he is committed to fixing the bank’s problems. Thursday’s hearing before the House Financial Services Committee showed that the issue has political staying power, said Jaret Seiberg, an analyst with Cowen and Company, in a research note Friday.

The issue will likely spread to other banks, with lawmakers calling for probes of industry practices and legislation to break up big banks, he wrote.

“The independent directors on the board of Wells Fargo have about six weeks to devise a plan for the future,” Seiberg said in the note. “If they are going to change management, now is the time to act. And if they plan to back Stumpf, then the bank needs to use the (congressional) election recess to devise a political strategy to justify the decision.”

Other investigations are already piling up for Wells Fargo.

The Labor Department has launched a review of how the bank treated its employees, and the Observer has reported that federal prosecutors in Charlotte and San Francisco are heading up an investigation of the bank.

In a CNBC interview Monday, JPMorgan Chase CEO Jamie Dimon said his bank has received information requests from various agencies in the wake of the Wells Fargo controversy, saying when someone “does something wrong in the industry everyone gets request from everybody else.”

On Monday, Deutsche Bank analysts lowered 2017 earnings per share estimates for Wells Fargo from $4.12 to $3.97 to “account for the potential ongoing impact of the company’s sales practices.” The bank continues, however, to keep a “Buy” rating on the stock.

Wells Fargo is scheduled to report its third-quarter earnings Oct. 14. The bank’s shares are down about 12 percent since the scandal emerged, falling 1 percent to $43.83 Monday, on a down day for the markets. The stock hasn’t been this low since the spring of 2014.

Bloomberg News contributed.

___

(c) 2016 The Charlotte Observer (Charlotte, N.C.)

Visit The Charlotte Observer (Charlotte, N.C.) at www.charlotteobserver.com

Distributed by Tribune Content Agency, LLC.

Advertisement