GAU President calls Biden debt cancellation plan “drop in the bucket”

January 24, 2021

Anna Wilcoxen, the president of Graduate Assistants United at SIU, criticized a proposal by President-Elect Joe Biden to move a $10,000 student debt cancellation proposal through congress.

An aide from the incoming Biden administration confirmed the plan on Jan. 8, according to CNBC.

The announcement comes after months of public pressure on elected officials by a variety of organizations to make student debt cancellation part of a COVID-19 relief package.

Advertisement

Near the beginning of the pandemic, a coalition of Illinois labor groups, including Service Employees International Union Healthcare, National Nurses United and the Chicago Teachers Union called for debt forgiveness as part of a slate of state financial relief programming.

Two hundred thirty eight organizations signed on to an open letter in November demanding the incoming Biden administration cancel student debt by executive order on the first day of his presidency.

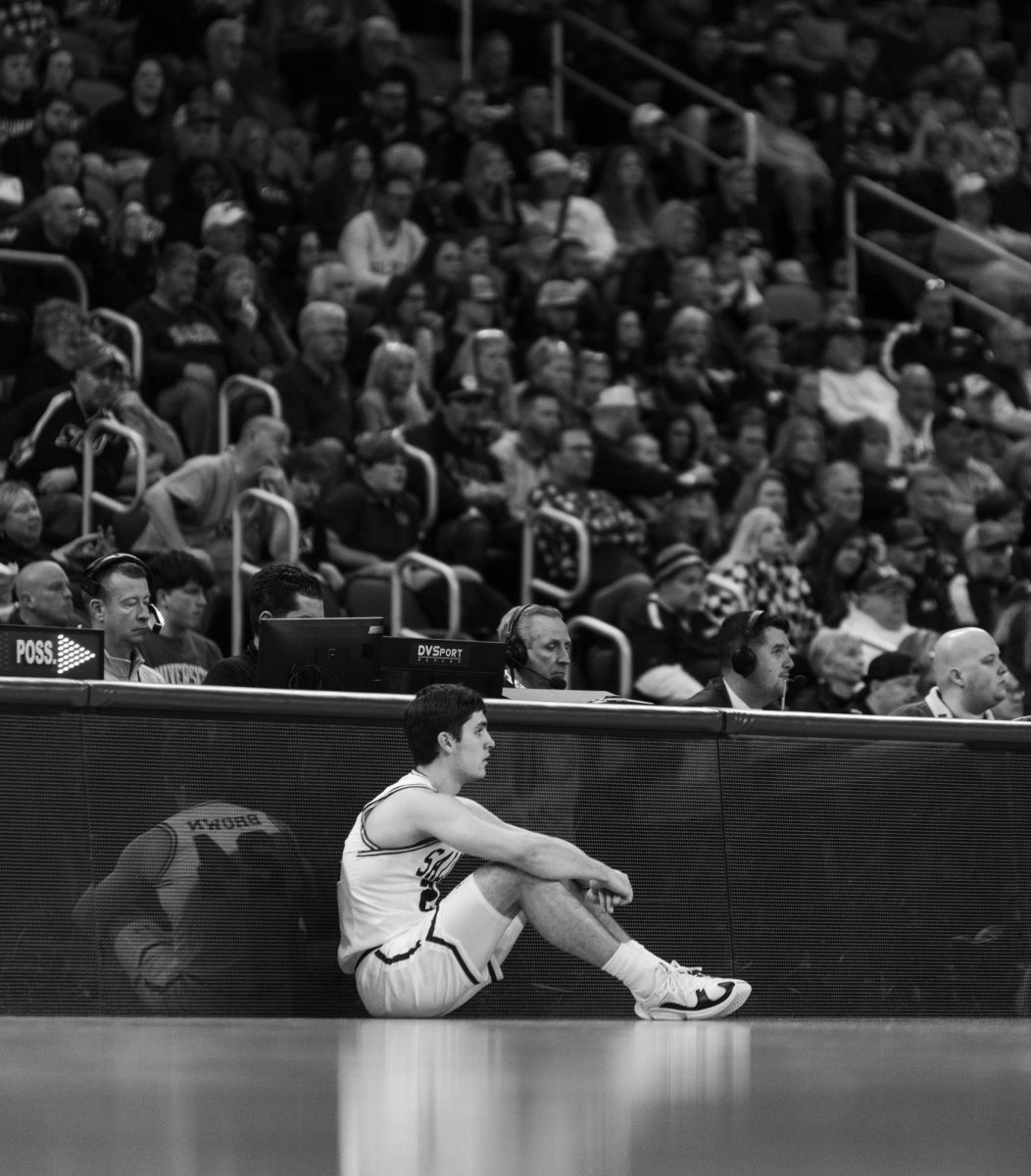

CJ Clark graduated from Southern Illinois University at Carbondale in May of 2020 with $15,000 in debt. He said he also believes there should be a plan to address the student debt situation.

“COVID has changed a lot,” Clark said. “I really think that it’s opening people’s eyes more towards the fact that, the education itself gets to a point where, the amount of money doesn’t even seem like a real amount just because of how many digits there are.”

Linda Flowers, the president of the Carbondale branch of the NAACP, compared the student debt cancellation to previous business relief programs.

“Back during the housing collapse in 2008, we bailed out the automobile industry, we bailed out the bank industry, and then those industries have gone on to thrive, right. Here with COVID we are bailing out the airlines,” Flowers said. “I don’t see why, if we can bail out businesses, billion dollar, trillion dollar businesses, we can’t bail out those people with student loan debt.”

Student debt troubles are more pervasive among black graduates who are five times as likely as their white peers to default on their student loans according to a report by the Brookings Institute.

Advertisement*

“That’s like the gap between everything else in this country,” Flowers said. “Just like medical, education, everything bad, COVID, seems to have a disproportionate impact on the black community. So does the student debt crisis.”

A variety of plans to deal with student debt cancellation have been proposed including one by Bernie Sanders to cancel all student debt, and more conservative proposals to cancel $50,000 in student debt drafted by Elizabeth Warren and Chuck Schumer.

“There are a lot of folks who might say, what could you possibly need all that money for, and those folks are probably people who went to school in the 90’s or before, you know, fees and tuition and other things, just cost of living skyrocketed,” Wilcoxen said. “$50,000 is still a drop in the bucket to people who are getting PhDs, but $10,000 is even obviously a tinier drop in that bucket.”

The average student loan debt for SIUC undergraduate students is $25,285, and the average student loans debt for students getting graduate and professional degrees is $49,410 according to SIUC Director of Financial Aid Dee Rotolo.

Collin Bullock graduated from SIUC in 2007 with a degree in creative writing and never had to take out loans, but said he’s still in favor of cancelling all student debt.

“As I understand it, Biden could do an executive order to cancel all of it,” Bullock said. “I think that that’s obviously going to be unpopular with people with a lot of money because, at this point in 2021 America, debt is really the only thing we produce at a large scale anymore.”

Though cancellation would provide relief for people with student debt, it would have no immediate impact on SIUC because the university does not hold the federal loans that would be targeted according to Rotolo.

Flowers said one of the core issues with student debt, now, is that students are no longer able to find jobs that pay enough to manage the expenses they’ll take on after leaving college.

Between 1990 and 2020 the average cost of tuition and fees increased from $3,800 to $10,560 according to a report by the College Board.

Wages for college graduates only increased by 2.8% between 1990 and 2015 when adjusted for inflation according to a report by National Association of Colleges and Employers.

“When I graduated from college, you were pretty much guaranteed a job if not in your field of study, a job in a field where you could make a living wage,” Flowers said.

Flowers said she now sees graduates are often pushed into lower wage jobs.

When Bullock left SIUC he started working three jobs, one as an aide to special needs students, another as a substitute teacher, and a third at a “porn shop” to make ends meet.

“The drivers of the economy are, you know, middle to lower class people ultimately,” Bullock said. “If you forgive people’s student loan debt, you know what they can do? They won’t default on mortgages, they can start businesses, they can buy things, they can buy things locally, they can keep things going.”

Adam Holbrook went to SIUC for undergraduate and graduate degrees, and now has $30,000 in debt from his graduate education.

“I’m very fortunate that I do not have undergraduate debt because I would not have spent as much time with my own personal development, and learning the things that I did in college if I had to worry about paying off tens of thousands of dollars of debt,” Holbrook said. “I think now getting an undergraduate degree is sort of comparable to 40 years ago going through high school, as far as what jobs that will net you and what salary it sort of corresponds to.”

Holbrook said he’s hopeful that the conversation he sees around student debt cancellation has changed, in part because of the COVID-19 pandemic.

“I think the people that I see on Facebook posting memes, now, about give us our $2,000, and anything related to pandemic economic troubles are the same people who, two or three years ago are posting about, like, anti-welfare memes and stuff.” Holbrook said. “As cynical as it sounds. There are a lot of people in this country who are unwilling to advocate for change unless it affects them directly.”

Staff reporter Jason Flynn can be reached at Jflynn@dailyegyptian.com or on Twitter at @dejasonflynn. To stay up to date with all your southern Illinois news, follow the Daily Egyptian on Facebook and Twitter.

Advertisement