Students protest educational debt

April 13, 2014

Roughly 20 years ago, an SIU student accepted her very first credit card just outside Faner Hall. Now at age 65, Rene Cook, of Carbondale, said she is still in debt after graduating in 1996 because of that longtime-regretted credit card, along with her ever-dwelling student loans.

“I don’t know what I could’ve done any differently,” she said. “I’ve only used my credit cards to maintain (my debts), not to buy anything.”

Cook graduated with a degree in university studies and said it did not help her get a job after school. She said attending college is no longer worth the debt that follows.

Advertisement

“I think we should go to a system like other countries have where they value young people as a resource,” Cook said. “We have this all back-asswards.”

According to the Federal Reserve Board of New York, 37 million student loan borrowers have outstanding student loans.

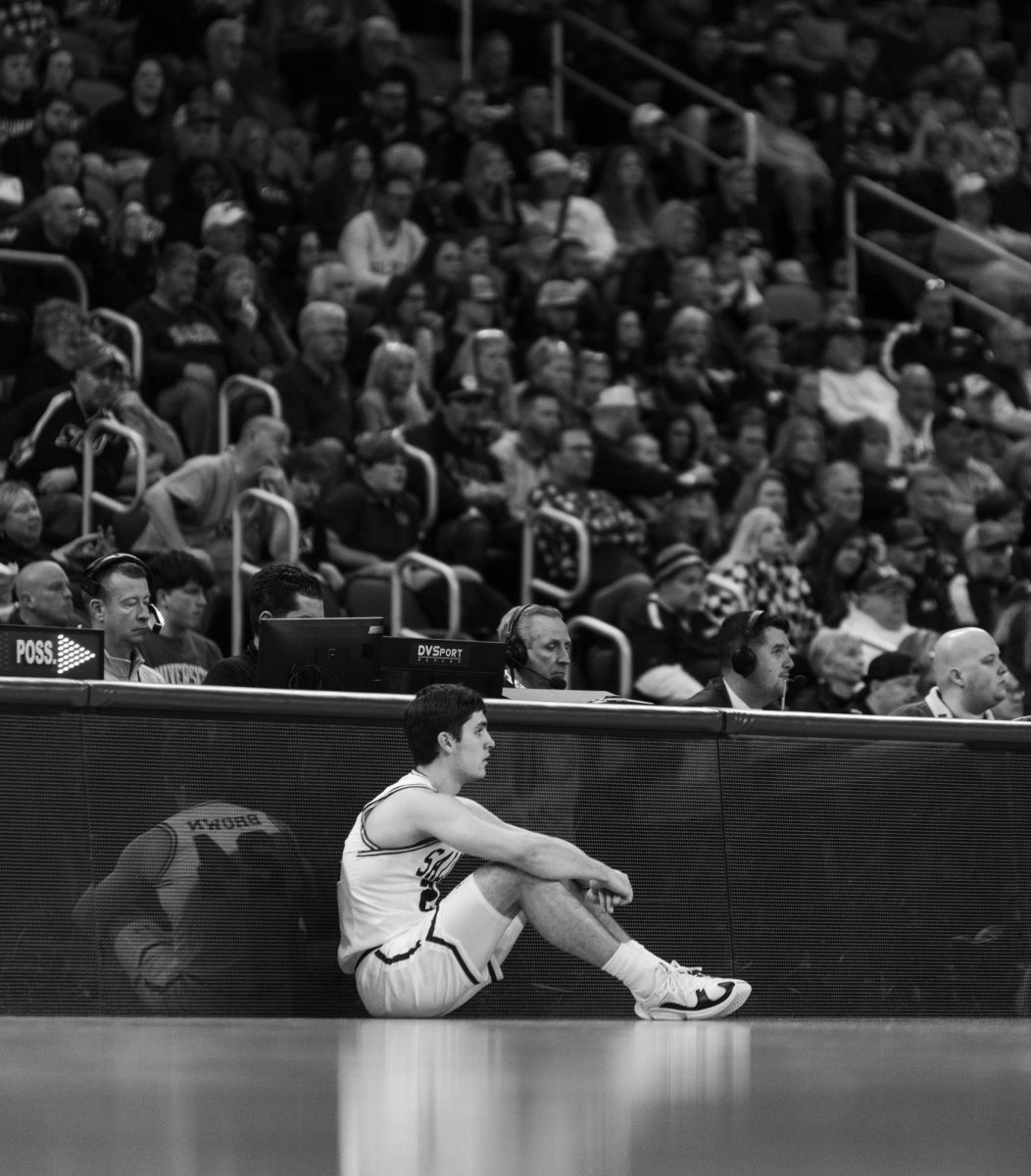

Nearly 35 students and community members assembled at 2 p.m. Thursday on the north side of the Student Center to discuss these issues, and the anxiety debt creates.

Strike Debt Carbondale, Graduate Assistants United and SIU Socialists assembled the protest and held a banner that read, “Alone: they own you. Together: we own them.” It is the first debt assembly put on by these groups.

Adam Turl, president of SIU Socialists, said the purpose of the protest was to show student debt is a structural problem and is not a difficulty someone in debt should be ashamed of.

“Student debt loans now in the United States is upward around $29,000 in some parts of the country per student,” Turl said. “It’s even higher for graduate students.”

According to the Consumer Financial Protection Bureau in 2012, Americans owe more than $1 trillion in student loans.

Advertisement*

Nick Smaligo, a graduate student in philosophy from Carbondale, said most people take the first job they can get after school, even if it is something they don’t enjoy, in order to pay off their debt.

“You spend the next 20 or 30 years of your life paying back the banks that you took out loans for in order to qualify for a job,” he said. “So you basically borrow in order to work in order to pay back what you borrowed in order to work.”

Turl said another issue students face is the continual debt put on students’ families for attending school.

“It doesn’t make sense because for the most part we are talking medical bills and education,” he said. “Things that you have to do to make a better life for yourself or that are unavoidable if you want to stay alive.”

Turl said too many people are in debt. According to the Federal Reserve’s Quarterly Release on Household Debt and Credit released in February 2012, one in seven Americans are being pursued by debt collectors.

He said government funding plays a large role on how much students fall into debt.

“Here at SIU a couple decades ago, more than 70 percent of SIU’s funding came from the state of Illinois. Now we’re down to about 30 percent,” he said. “That means the cost of educating people has shifted off of society as a whole, including wealthy taxpayers, and then shifted on to working class and poor people trying to attend school.”

Smaligo said education should be considered a human right.

“An institution profiting off of another person getting access to something that is a human right is a fundamentally injustice institution,” he said.

Gabe Garcia, a senior from Chicago studying geography and environmental resources, said the education system is not efficient.

“It just doesn’t seem just or fair,” Garcia said. “It is a good business model. Obviously the federal government wants to make money from people and they got it down to a science.”

Smaligo said the next assembly will be at 3 p.m. Thursday on the north side of the Student Center. He said all are welcome and will be supported.

Cook said more debt education may help students from accruing large amounts of debt.

“I’m a great-grandmother. These kids, most of them don’t even have families yet, and so it’s not too late to make some changes,” Cook said. “Maybe if more of us didn’t come to these places, they’d crumble under their own weight and we could start over.”

Luke Nozicka can be reached at [email protected], on Twitter @LukeNozicka, or 536-3311 ext. 268.

Advertisement