Scorecard answers need, misses point

February 19, 2013

Prospective college students will soon have a new way to put institutions to the test.

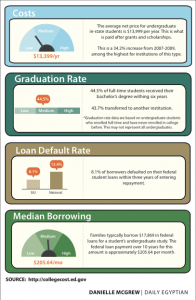

The scorecard program, which President Barack Obama re- introduced during his Feb. 12 State of the Union address, will display the graduation rate, average cost of attendance per year and median loan payments expected for any institution selected, according to the White House’s web site. The new program will provide students a way to compare education costs and benefits, but university officials said the data may be skewed and other programs may present more accurate information.

While the scorecard program is new, Chancellor Rita Cheng said in an email that the university has long been up front with its costs.

Advertisement

“The scorecard is consistent with my focus on student success and completion, preparing students for post-graduation economic and life success and keeping the cost of college affordable,” she said.

The scorecard uses data provided by the U.S. Department of Education’s College Affordability and Transparency Center, but Cheng said the data isn’t quite what it’s made out to be.

“Unfortunately, much of the data is old and available from other sources, so in that way not much help,” she said. “In particular, the university’s data on tuition and fee increases is from 2007-2009 and not relevant today.”

Cheng said the scorecard’s data reflects costs for only full-time freshmen who begin their college careers at the university, and it does not include transfer or part-time students.

Families need more concise information, she said.

“In addition, the scorecard has averages and medians, not individualized information,” Cheng said. “What families need is information on how much they will pay (individually), not averages.”

Financial aid director Terri Harfst said the university has offered the same information as the scorecard to prospective students for some time.

Advertisement*

“The university has always put everything out front for students, every part of our cost of attendance from room and board to living expenses like gas and ordering late-night pizza,” she said.

Harfst said families needed a regulated system to compare different colleges’ cost, but the scorecard isn’t necessarily the best solution. She said the shopping sheet, a new federal program that allows a school to break down its cost of attendance line by line and uses a student’s FAFSA information to determine individualized costs, is a better solution.

“The Department of Education has realized the need for these numbers to be communicated to students and families, but I believe the new shopping sheet program is more appropriate,” Harfst said.

Universities must elect to join the shopping sheet program. While it may be difficult to compare schools that participate with those that don’t, Harfst said more schools join frequently.

“Sometimes the total cost of attendance can be fairly shocking,” she said. “It’s easier to digest when it’s broken down and you can see where the money is going.”

Cheng said she does not think the new programs will negatively impact university enrollment.

“We will continue to provide our own, more individualized, information to prospective students and families,” she said. “As well as communicating the value, and relative low cost, of a degree from our university.”

While the programs seek to help families choose the right college, students have their own ideas about whether they receive enough educational value per dollar.

Sarah Niebrugge, a freshman from Teutopolis studying photojournalism, said she understands why the program is needed, but she thinks her individual education is worth the amount of money she pays for it.

“Even if the scorecard had been available when I decided to come to the university, I would still have chosen SIU,” she said.

Mark Muellner, a senior from Aurora studying criminal justice, said he thinks the scorecard program is a waste of both time and money.

“This information is already available to prospective students,” he said. “Including the announcement of a program like this during the State of the Union was not a great use of time.”

Muellner said he is satisfied with the education value the university provides. However, he said attendance costs affect him less because he received the Post 9-11 G.I. Bill, which covers tuition and fees equal to the state’s most expensive public school.

“If you’re an incoming freshman, you should absolutely be given a breakdown of exactly what college will cost you,” he said. “Not just tuition but living expenses too, and the scorecard isn’t individualized enough to help new students make this life-changing decision.”

Advertisement